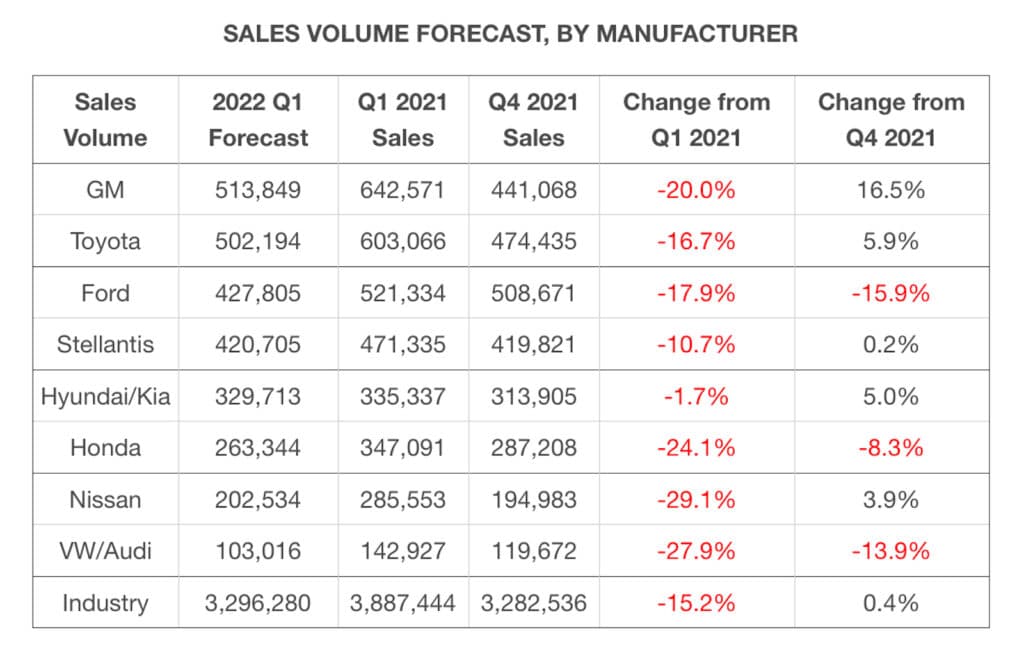

In what will be a surprise to virtually no one, new vehicle sales for the first quarter of 2022 are expected to be down 15.2% when automakers begin reporting the results on Friday.

Analysts at Edmunds.com predict car companies sold a little less than 3.3 million vehicles during Q1, which is a decrease on a year-over-year basis, but a 0.4% improvement compared with the fourth quarter of 2021.

The reasons for the drop remain the same as they have been for some time now, Jessica Caldwell, Edmunds’ executive director of insights, said.

“Skyrocketing gas prices were top of mind for consumers in March, but the lack of inventory is what ultimately depressed new vehicle sales in the first quarter,” she said.

“Automakers are still grappling with ongoing disruptions to supply chains and production created by the chip shortage and COVID-19; on top of that, they’re likely facing new challenges as a result of the invasion of Ukraine. This combination of headwinds could mean that these inventory issues will persist well into the rest of the year.”

Get ‘em while you can

Not only are inventories down, the vehicles that are arriving on dealer lots are leaving almost as quickly as they can be unloaded from the car carrier. Edmunds says 41% of all new vehicles are sold within their first week on a dealer lot. It was only 20% during the year-ago period.

While there’s been plenty of news about how electric vehicle sales are setting new records — up more than 80% in 2021 with that number expected to essentially repeat itself this year — shoppers are buying all vehicles quickly with the average days-to-turn data showing drops across the board.

- Electric vehicles dropped to 21 days, compared to 63 days in March 2021. 39% of all EVs sold within the first week of arriving on a dealer lot in March 2022 compared to 24% a year ago.

- Hybrid vehicles dropped to 15 days, compared to 48 days in March 2021. 54% of all hybrid vehicles sold within the first week of arriving on a dealer lot in March 2022 compared to 27% a year ago.

- Gas-powered vehicles dropped to 20 days, compared to 62 days in March 2021. 43% of all gas-powered vehicles sold within the first week of arriving on a dealer lot in March 2022compared to 20% a year ago.

- Diesel vehicles dropped to 23 days, compared to 36 days in March 2021. 39% of all diesel vehicles sold within the first week of arriving on a dealer lot in March 2022 compared to 26% a year ago.

Worst Q1 result in a while

Edmunds isn’t alone in its gloomy forecast for the first quarter. Cox Automotive estimates quarterly sales will decline more than 16% from Q1 2021 when 3.9 million units were sold; Q1 2022 is forecast to end with 3.3 million sales and mark the second-worst quarter for new-vehicle sales in a decade, behind only Q2 2020, the height of the global COVID-19 pandemic.

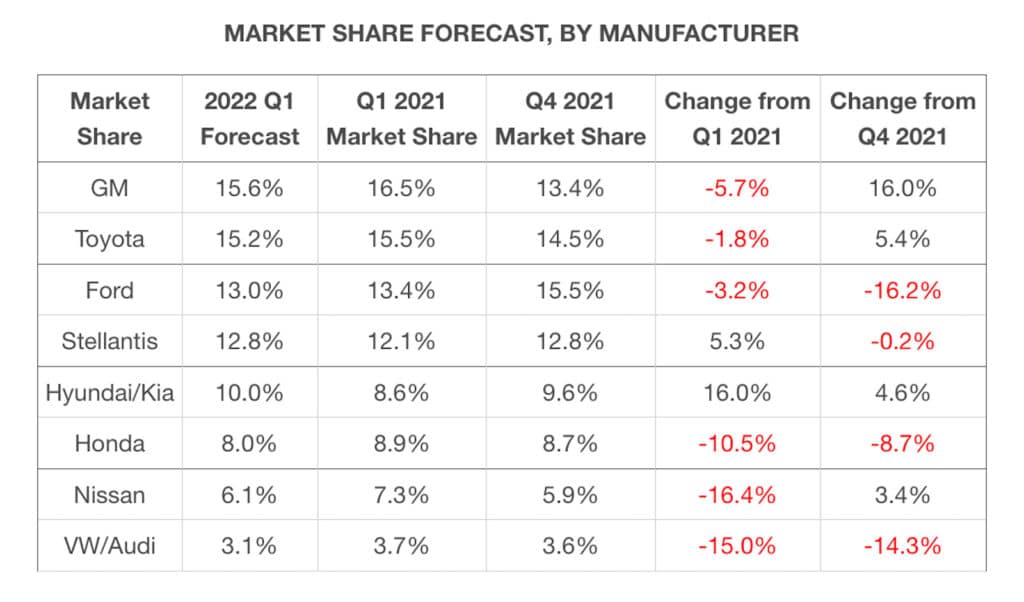

While sales may be down, someone’s still going to be No. 1 and Cox analysts believe that will be Toyota Motor Co. (Toyota and Lexus combined), which simply is a carry over from all of 2021. Others have reasons to be optimistic, including Hyundai and Tesla, which continue to gain share. However, General Motors is expected to “drop notably” in the first quarter.

No one will be happy as slow sales are expected to carry on.

“Make no mistake, this market is stuck in low gear,” said Cox Automotive Senior Economist Charlie Chesbrough. “March sales volume will tick up from February, but this is not due to a substantial change in the market.

“Low unemployment, relatively low interest rates—the conditions are right for higher sales. With three additional sales days, volume in March will rise month over month. However, seasonal adjustments reveal the true story: Sales remain weak and will basically be stuck at the current level until more supply arrives.”

According to estimates provided by analysts J.D. Power & LMC Automotive, the number of new cars sold in the United States is anticipated to decrease in April due to limited stocks, growing financing rates, and high demands of the consumers. As per a study that the experts published, commercial shipments of new automobiles in the United States might drop by 23.8 percent to 1,100,000 units in April compared to the same month a year before. Furthermore, according to the head of J.D. Power’s data analytics department, overall sales are expected to be significantly lower than the previous year since there are less than 900,000 vehicles in stock at dealers, although interest is still high.