Toyota announced Tuesday it will implement high-performance solid-state batteries and other technologies to increase the driving range and lower the price of its upcoming electric cars.

The automaker’s newly-revealed strategy comes as competition is heating up in the rapidly expanding EV market, where Toyota lags behind its rivals, most noticeably Tesla. The new proposals tackle a range of issues, the plans having come together under new Toyota CEO Koji Sato.

What Toyota is planning

According to Toyota, their next-generation lithium-ion batteries will have better range and faster charging, starting in 2026.

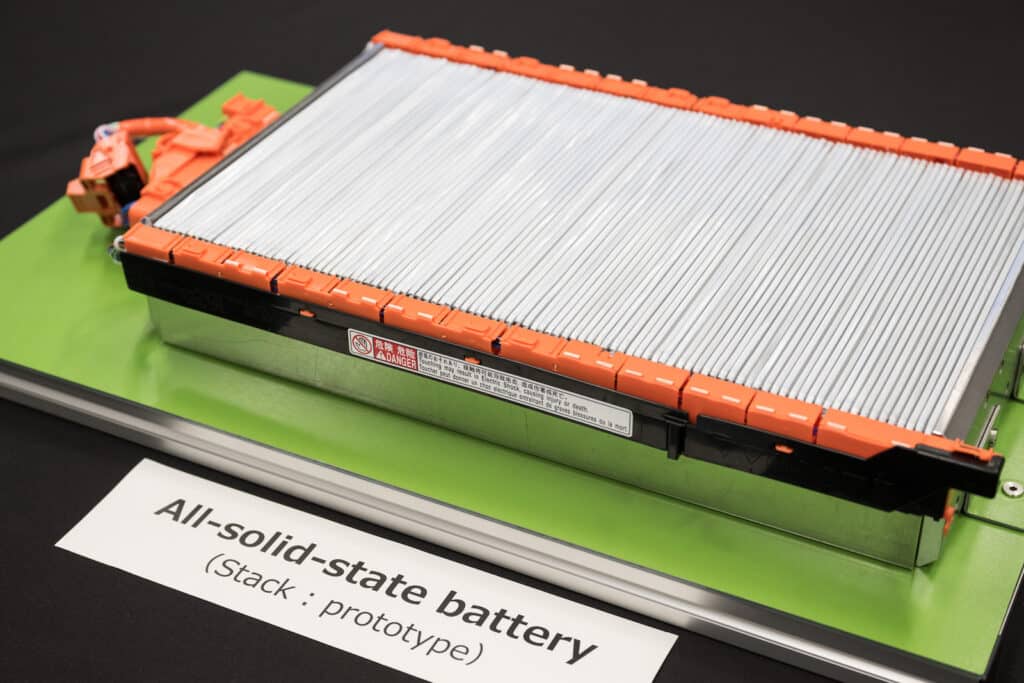

The company stated it has achieved a “technological breakthrough,” having resolved solid-state batteries’ durability issues without providing details. It claims to be working on a method to mass produce the batteries for 2027–2028 with a 746-mile range, a recharge time of less than 10 minutes and a cost 20% lower than current batteries. All would be impressive breakthoughs.

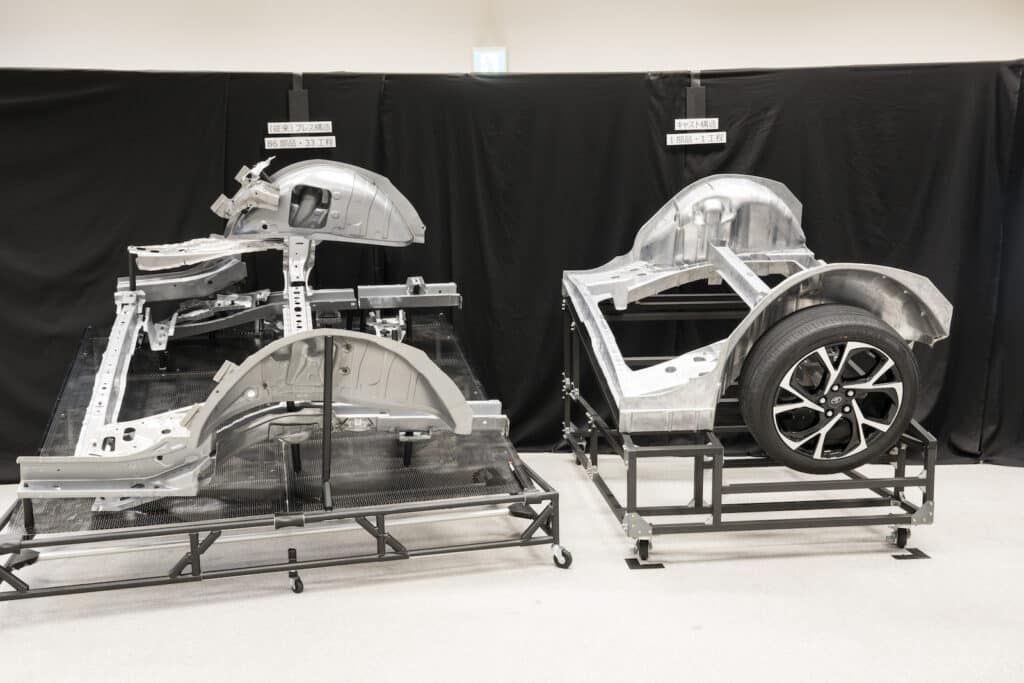

In addition, Toyota plans to manufacture its EVs using three main components in a new modular structure, which officials claim will cut vehicle development costs and factory investment. It will also employ Giga casting, a production process pioneered by Tesla to simplify production.

The automaker is also working with rocket scientists at Mitsubishi Heavy Industries, according to a Reuters report, to improve aerodynamics of Toyota vehicles. Lucid Motors currently produces the most aerodynamic vehicle, the Lucid Air which boasts a drag coefficient of 0.197.

Toyota will launch its new full line of BEVs in 2026.

A contentious meeting

The plans were announced a day before Toyota’s annual shareholders meeting, which is shaping up to be a faceoff about former Chief Executive Officer Akio Toyoda’s cautious electric vehicle strategy.

Numerous shareholders, including the California Public Employees’ Retirement System, the New York City Comptroller’s Office, and some European asset managers, claim they intend to vote to remove numerous Toyota directors, including Toyoda, from their board seats at the Wednesday meeting.

The votes are meant to protest Toyoda’s not establishing a deadline by which the automaker’s line-up will be entirely electric, citing governance difficulties as one reason. Nevertheless, it’s unlikely that Toyoda, the grandson of the company’s founder, will be ousted from the board.

Toyota officials say the company is committed to cutting carbon emissions from new vehicles by at least half by 2035 and becoming a carbon-neutral operation by 2050, although that no longer seems to be enough for some of the company’s militant green shareholders.

Toyota’s Slow Turn to EVs

Toyoda has been a rare voice of caution over the blind rush to EV implementation, claiming correctly the world isn’t prepared to switch entirely to electric vehicles. Specifically, Toyoda notes there’s a lack of suitable charging infrastructure and battery materials, as well as the dependence by many countries on carbon-emitting fossil fuel to produce electricity.

Instead, Toyoda sees gas-electric hybrids as a bridge between conventional cars and EVs. Toyota has sold more hybrids than any other automaker.

After serving as CEO of Toyota for over 14 years, Toyoda was named company chairman in April.

What’s the difference?

Lithium-Ion batteries use a liquid electrolyte that manages energy flow between the cathode and anode through a separator. Aside from the weight of the liquid, it’s also flammable, and can be unstable at high temperatures, leading it to explode or catch fire.

By contrast, solid-state batteries have solid thin electrolytes to carry lithium ions between electrodes, making them far more stable and smaller in size. The solid electrolyte is also lighter, faster to recharge and hold more energy than lithium-ion batteries. Finally, they’re also more resistant to degradation over time. They’re currently used in items like pacemakers and smartwatches.

But solid-state batteries are expensive to manufacture and prone to cracking. And they cost about eight times more to make than a comparable lithium-ion battery. Still, many automakers, including Mercedes-Benz, Volkswagen, BMW, GM, Ford, Stellantis, Nissan, Porsche and Hyundai/Kia are all said to working towards creating a solid-state battery that can be mass produced.